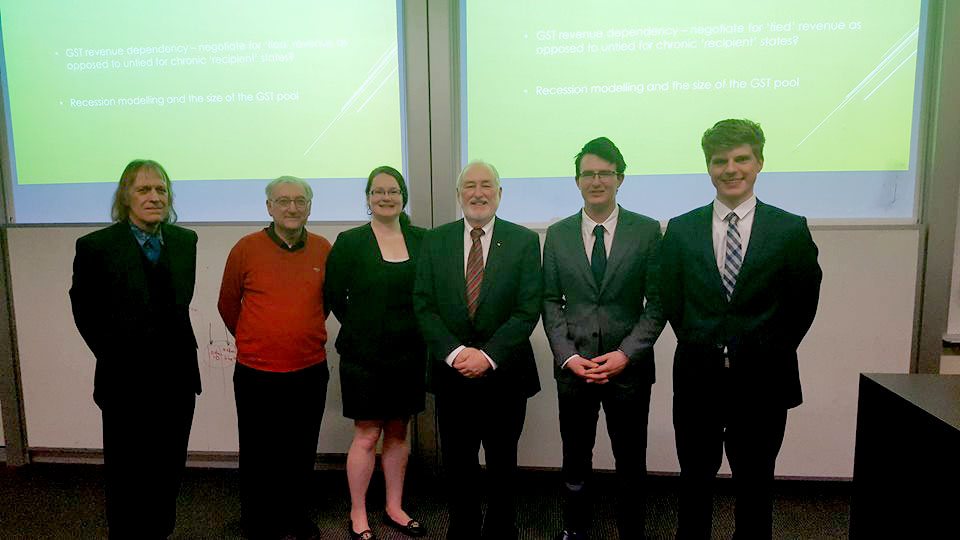

From left to right: Associate Professor Dr. Peter Earl, School of Economics, Dr. Bruce Littleboy, School of Economics, Sally Duncan, Professor Jeff Mann of ELRI, Jack Donnelly and Laurie Bristow.

ELRI and The University of Queensland Economics Society (UQES) held another successful “Policy Pitch Competition.”

It involved the entrants researching a topic of their choice, making a 10 minute presentation and being cross examined by the panel comprised of Associate Professor Dr. Peter Earl, School of Economics (UQ) Dr. Bruce Littleboy, School of Economics (UQ) and Professor Jeff Mann, Director of ELRI. Again, the standard of the papers and the presentations were very high. The Panel of judges decided that there be joint winners, Sally Duncan “Shock and Ore – WA’s GST Redistribution Woes” and Jack Donnelly and Laurie Bristow “Mates Rates”.

You can access the papers of the finalists below:

Download PDF: Land Value Tax Daniel Yanes Sanchez, Santiago PollmeierDownload PDF: Inheritance Tax in Australia Dominic Steven-Roberts, Antonius Bekti Brief

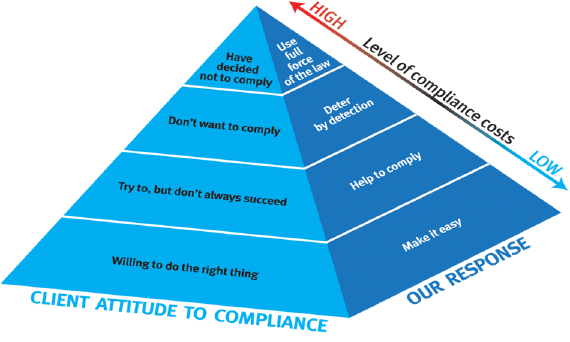

Download PDF: Mates Rates Laurie Bristow, Jack Donelly

Download PDF: NDIS: Enabling Change Liam Hickey

Download PDF: UQES Policy Pitch Madeliene Briggs

Download PDF: Shock and Ore – WA’s GST Redistribution Woes Sally Duncan

Download PDF: Fixing Australia’s Gas Market Will Garske, Stanley Kerne

Download PDF: The Super Norm Zoya Sapara, Jane Tin